The Future of Restaurant Tech: Serving the Next Course

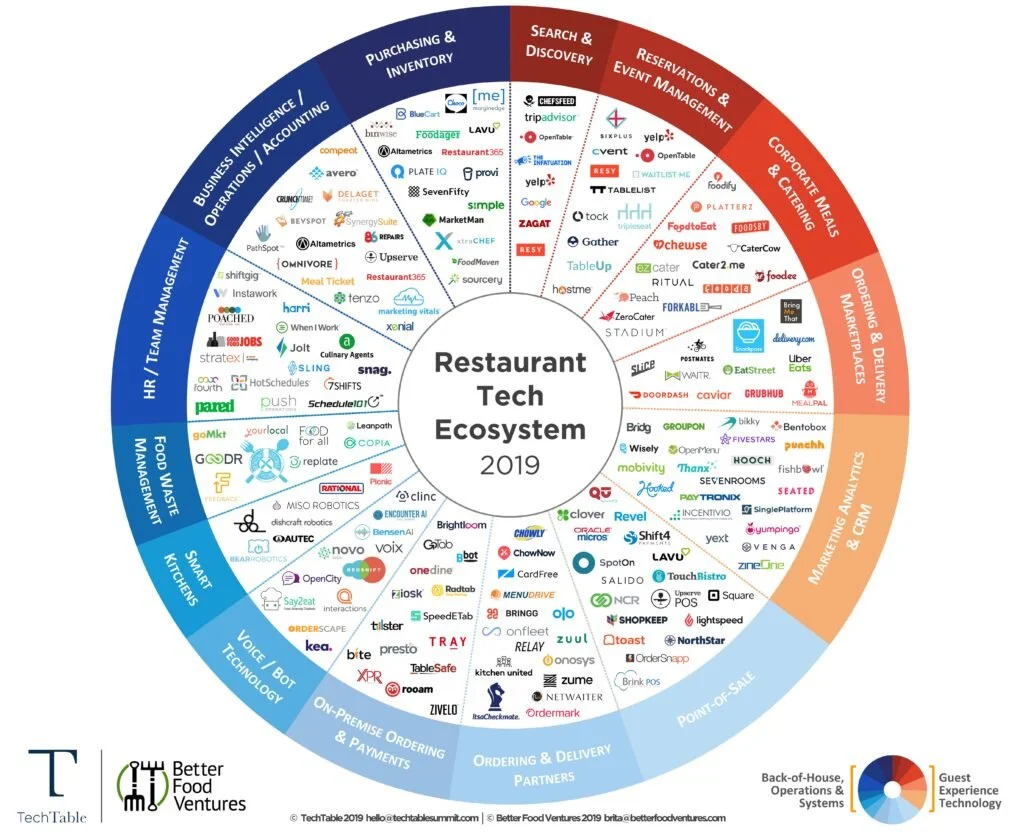

In collaboration with TechTable, a platform and annual summit dedicated to innovation at the intersection of hospitality and technology, we are sharing an updated 2019 Restaurant Tech EcoSystem map, and our thoughts on the emerging themes and trends within the restaurant tech industry.

Setting the Table

After publishing our inaugural state-of-the-restaurant industry report in 2018, we are pleased to share an updated 2019 Restaurant Tech EcoSystem map, as well as highlight some of key shifts we’ve seen across the industry over the past year and our predictions for the year to come.

As has been the case for a couple of years now, technology solutions within the restaurant and hospitality industry have been continuing to evolve at such a fast pace that it’s hard for even those of us who work in the space to keep up. Thus, in order to help operators visualize the myriad of distinct and overlapping capabilities across the restaurant technology ecosystem, we created this industry landscape to serve as a heat map of the ecosystem. By no means is this an exhaustive listing.

And now, we turn towards the notable themes and emerging technology trends we are seeing as we head into 2020:

Digitizing the Back of House

In looking at the updated 2019 map, versus the 2018 edition, one thing sure stands out: There has been a notable shift toward a growing number of solutions focused on back-of-house operations and systems (versus guest-facing solutions).

Up until recently, the restaurant tech market was primarily pushing out guest-facing tech solutions, however as operators increasingly embrace digitalization of their business, we are seeing improved opportunities (and business models!) to optimize operations via actionable, data-driven insights and services.

We are encouraged by the continued push towards smarter B2B solutions that are helping restaurant and hospitality partners to increase efficiencies and more broadly, helping to combat the myriad of issues currently cannibalizing margins.

Expansion of Mobile Opening Up New Categories

We have seen the proliferation of mobile technology create significant change to the ordering, payments, and guest communications landscape. We are seeing new crops of technologies focused on more efficient line busting, pre-ordering, payments, location-based marketing, to name a few. Frictionless URLs, and the resurgence of QR codes / NFC tags are enabling customers to check-in for orders placed outside the venue (to send the order to the kitchen), or if the customer is at the table to place an order from the table.

White Label Loyalty and CRM Well-Positioned for Growth

As detailed in the 2019 Food Tech State of the Industry Report, we’ve increasingly seen a myriad of issues cannibalizing operators’ margins, including rising rents and labor costs, as well as the onslaught of third-party ordering/delivery services.

Related to that last point – the leading third-party partners seem to be increasingly setting their sights on owning the customer’s entire journey. Grubhub’s recent launch of a loyalty program supports this thesis.

Thus, within a relatively short time, due to the ease, variety and scale offered via marketplace apps, we have seen the customer’s loyalty/purchase journey transform, bifurcating to either: 1) direct ordering from the restaurant (online or in-person), or 2) loyalty to the many ordering/delivery platforms.

Because of these considerable tensions, operators are going to need to invest in more ways to uphold their own brand and funnel customers into more profitable channels.

Emerging Tech Categories to Watch for 2020

In taking a step back to think about the coming year, we’d like to highlight the emerging restaurant tech categories with a higher number of younger companies, where we are seeing increased momentum and innovation:

Voice/Bots: Used for phone ordering, drive-thrus, search & discovery, brand marketing, and even back of house tasks like taking bar inventory

New On-Premise Ordering/Payments Tech: Including kiosks, facial recognition, mobile-driven ordering/payments, cashierless checkout

Managing and Minimizing Food Waste: Ranging from back-of-house kitchen waste management to a variety of food recovery solutions which range from “ugly produce” food procurement to matching leftover prepared food to consumers and food kitchens

Tech Focused on Increasing Customer Value: This concept straddles a number of categories (and was alluded to above in the discussion on new CRM/loyalty tech). Examples include employing smarter marketing, using personalization to drive increased order value, or simply minimizing 3rd party fees via white label solutions.

As is the case each year on this exciting journey, we continue to be encouraged by the massive potential and power of thoughtful technology solutions in this sector.

The restaurant tech ecosystem will continue to change as the industry matures, and as such, we depend on the wisdom of the participants in the space. We welcome your thoughts and reactions and look forward to following this sector together in the coming years.

Brita Rosenheim is a Partner at Better Food Ventures and The Mixing Bowl with 15 years of investment, M&A, and strategy experience within the food and food tech verticals. Her analysis on the Food Tech & Media sector is regularly used by participants in the space to understand the quickly evolving landscape.