Farm Tech Market Map: Why it’s time to distinguish farm tech from the messy supply chain

The agtech sector is expanding each year, and with that, the once-niche and all-encompassing term “AgTech” is becoming unmanageably broad. As recognized by AgFunder in its decision to launch a dedicated Farm Tech Investment Report this year, there are many innovators and investors focused on building new technologies specifically for the farm. But beyond the farm, agtech also includes what we call the “messy middle” of food and ag – “Supply Chain Tech.”

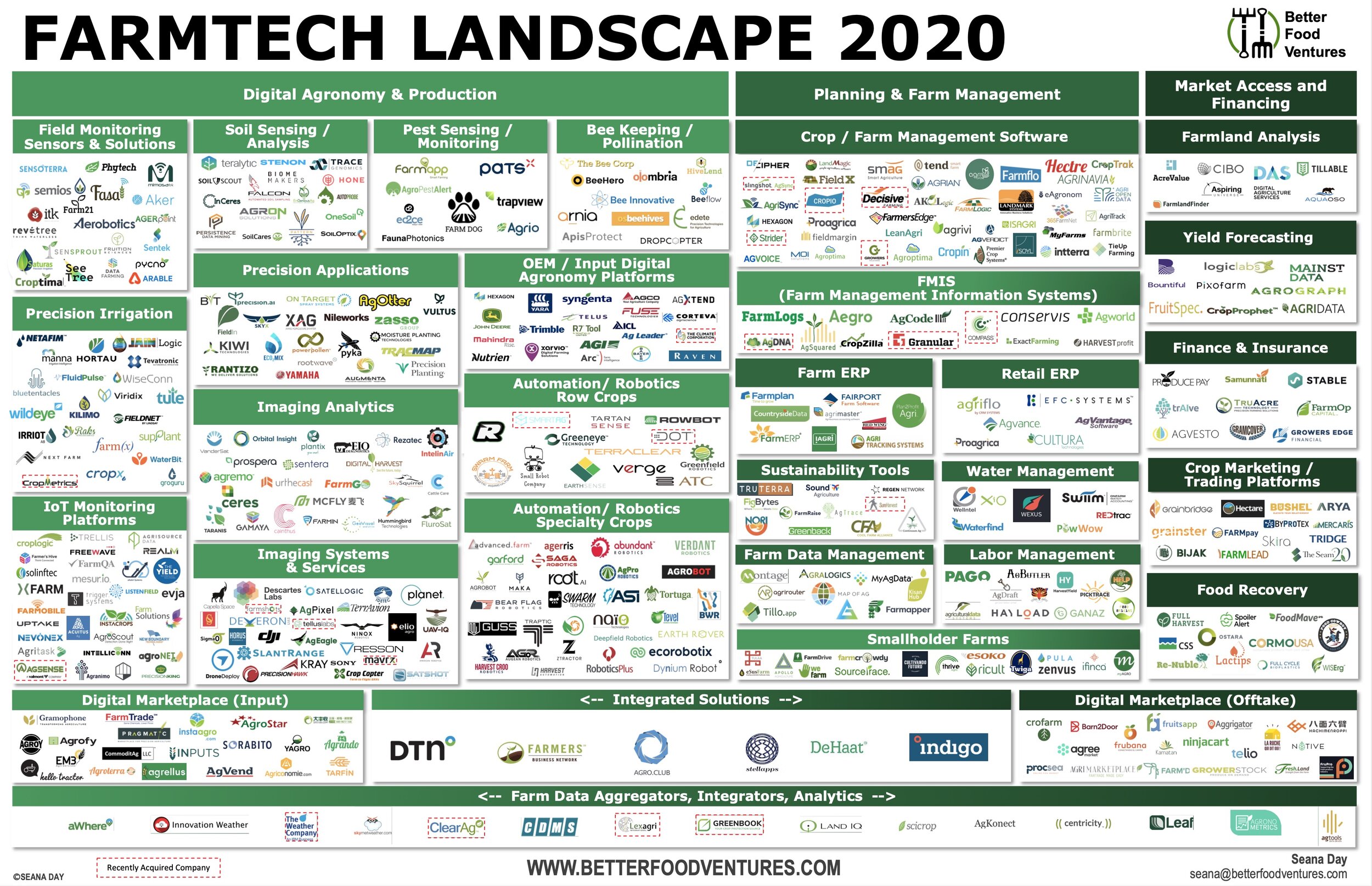

Thus, to recognize the growth in innovation both on the farm and in the supply chain, we decided it was time to bifurcate our AgTech landscape into “FarmTech” (inside the farm gate) and “Food Supply Chain Tech” (post-farm gate). Although we’ve visually separated the landscapes, I still emphatically believe it has never been more important to acknowledge the interdependence and need for greater integration between farms and supply chains. I recently wrote about food supply chain design principles to foster greater agility and alignment, and my partner, Rob Trice, published a companion piece looking at different innovation models for food and Ag.

In reality, it is messy on the farm and in the supply chain. Many of the traceability, remote sensing, and data integrators play in both camps. They offer solutions to both farmers and supply chain partners, so don’t be offended if your favorite AgTech category or company now appears in the new Food Supply Chain Tech landscape.

I am pleased to share Better Food Ventures’ 2020 FarmTech Landscape (available for download). It will be followed by the 2020 Food Supply Chain Tech Landscape, which my partner Brita Rosenheim, who authors the Food Tech Landscape, and I are creating in collaboration to reflect the increasingly integrated technology landscape of the “messy middle.” It will address the markets from the farmgate to retail and foodservice.

Orienting the FarmTech Landscape around the farmer

In a departure from prior year’s landscapes, we’ve organized FarmTech around the principle farmer activities:

Digital Agronomy and Production: encompassing much of the IoT, robotics, and automation, and remote sensing activity;

Planning and Farm Management: intersecting across digital agronomy, resource management, and business planning and execution; and

Market Access and Financing: tools and technologies used by farmers, farm managers, and crop buyers to access markets and financing.

For the most part, the focus is on production agriculture, but this year the inclusion of Smallholder Farming technology as a category was appropriate in recognition of the important work by entrepreneurs all over the world, as well as the recent funding activity that has taken place among some of these companies. These companies are enabling economic mobility, sustainability, and market access to hundreds of thousands of farmers in developing countries. Accordingly, I felt it was important to highlight this subsector.

Digital Agronomy and Production

There continues to be a proliferation of software-enabled hardware and sensor businesses with an analytics value proposition. While innovation is increasing the value of these technologies incrementally, limited data availability and quality are tempering long-awaited mass-market adoption. Big incumbent players like Deere and Climate Corp are clearly committed to building data platforms that have the scale to deal with these challenges. We’ve even seen moves from IT leaders like Microsoft with its FarmBeats platform and Google with it’s interest in “computational agriculture.” Yet business models are still in their infancy, and the appetite is cautious for funding substantial infrastructure investment with an unclear timeline to adoption or profitability.

As is self-evident from the sheer number of companies addressing discrete pieces of digital agronomy and automation, the market has yet to commit to common systems or platforms; this reinforces the industry’s fragmentation and hampers scalability. I’ve been predicting consolation for some time in this area, and although we have seen several notable deals in the last six months (Crop Metrics, SmartAg / DOT, ClearAg, to name a few), we have not yet seen a sizable wave. Facing an uncertain future with commodity farmer’s scaling back investment in new tech and capital markets tightening up, M&A activity is likely to accelerate in the second half of 2020 and 2021.

On the topic of FarmTech consolidators, the inclusion of incumbents was important to reflect in terms of both activity and R&D and marketing investment. To me, this signals both their commitment to digitalization as well as a fear of being left behind. This shift is likely to spur some fresh acquisition activity from those who have been “in the middle of the pack” as it becomes clear that a culture of innovation is not easy to foster internally. Buying tech talent and market-ready products can be more efficient than building them. That said, the number of digital agronomy systems offered by equipment or input companies can make it more challenging for startups, particularly when the incumbents have the balance sheet strength to run their digital products as loss leaders in the near-term and invest heavily in talent and R&D.

The automation and robotics space is crowded, particularly in high-value (high labor) specialty crops with few clear leaders or exits, beyond Blue River and Smart Ag/DOT. Startups like Bear Flag Robotics and Advanced Farm Technologies are experimenting with new “Robotics-as-a-Service” models to reduce adoption friction. The incumbents haven’t overlooked this trend in the traditional Ag value chain as digitally transformed business models enable “XaaS.” There is no doubt winners will emerge, but investors and entrepreneurs are going to have to be long this subsector.

Planning and Farm Management

One of the more challenging dimensions of the FarmTech sector has always been the ability to link agronomic activity to farm financials. For a variety of reasons, such as lack of digital standardization, interoperability, data quality, and behavioral friction, understanding the true cost of production and modeling scenarios to improve agronomic decision making has long vexed tech companies and farmers alike.

While Farm Management Information Systems (FMIS) may be a new term to many readers, some companies in the Farm Management Software (FMS) space have already begun to embed financial outcome analysis into their product suites. The companies in the FMIS subsector are advancing in the integration of digital agronomy, finance, and some lightweight Farm ERP functionality. This space will continue to attract attention from the incumbents and institutional finance with some already notable acquisitions and partnerships (e.g. AgDNA, Granular, Compass, and Conservis).

Market Access and Finance

The pace of activity at the intersection of financial technology innovation (FinTech) and AgTech continues to be intriguing for investors and entrepreneurs looking at creative financial products and solutions for growers facing an increasingly challenging financial picture. The availability of data to better understand market insights, risk, and supply and demand as well as utilize smart contracts (blockchain-enabled or otherwise), has created a wave of companies focused on helping farmers up their game when it comes to the business of farming.

A cautionary note, many FinTech companies are built on exploiting asymmetric data, and this could be risky for farmers with weaker balance sheets as the economic landscape becomes direr. According to the USDA’s Economic Research Service, working capital levels for US producers across the Ag sector continue to hit alarming lows, having declined since 2012. Working capital is the lifeblood of farms and the driver of FarmTech investment. In that way, the time has never been more important for FarmTech companies to demonstrate a clear ROI to rationalize wallet share.

Looking ahead to 2021

We will likely see a Covid-19 induced investment pullback as investors need to allocate more dry powder to their existing portfolios while tempering their new investment activity. In the recently published AgFunder FarmTech Investing Report, it was noted that the economic fallout from the Covid-19 pandemic would no doubt impact the consistent growth in FarmTech investment. Indications for Q1-2020 investment levels were around $550 million, which is far below the ~$1 billion raised in the first quarter of the past two years, and several hundred thousand less than Q1-2017.

Looking ahead with cautious optimism, it may finally be data’s time to shine. We heard about data ad nauseum for too many years, but translating it into actionable intelligence for the farmer remained largely elusive. With data quality improving and the cost / availability of computing power, artificial intelligence, and machine learning becoming more accessible, the tide may be shifting. The FarmTech sector is still waiting for a big data platform leader(s) to emerge, and it requires significant capital investment and domain focus, but it feels like we are moving ever closer to a world of interoperability and integrated “systems of systems” than any time before.

Although rural connectivity is still woefully inadequate and adoption barriers remain, key aspects of digital infrastructure are starting to fulfill the promise of FarmTech. If you think about the investments in massive datasets, 53% of the $836 million invested in Farm Management Software, Sensing and IoT went into just nine deals in 2019…all in aerial remote sensing companies. I think this suggests that we are getting a feel for the power of scalable data sources. This doesn’t at all minimize the importance of ground-truthed data from IoT monitoring and remote sensing in the field; in fact, it enhances the value of the data for better decision support.

Having been sheltered-in-place in my beloved hometown of Turlock, California, where I have lived for the last six years, I’ve seen firsthand that the farming sector has been as resilient as we could have hoped for. The production of agricultural goods, by and large, was not the challenge during Covid-19. Rather, it was the post-farmgate “messy middle” where the systemic issues that have been known for decades were exposed. On that, we will explore the potential for innovation and investment much deeper in our soon to be released 2020 Food Supply Chain Landscape.

FarmTech Landscape Map background and methodology

This is heatmap more than a comprehensive list. I would suggest you use the landscape as I do, as a tool to provide perspective on where activity is (or is not) and recognize some of the noteworthy companies in particular sub-sectors of FarmTech. The goal of the landscape is not to exhaust your eyes with a comprehensive list of all of the FarmTech startups and companies.

Focus on IT for farming: The landscape focuses predominantly on digital technology-related companies, corresponding to my experience and that of my colleagues at Better Food Ventures and The Mixing Bowl.

Digital agronomy becoming table stakes for incumbents: This year, I also felt it necessary to recognize the work being done by many of the Ag industry bellwethers as digitalization and technology plays a central role in long-term strategies and corporate investment activities. Most could fit in multiple subsegments with their integrated equipment and software offerings, but the spirit of this landscape remains on highlighting the activity of earlier stage, growth companies.

Focus on crops and outdoor agriculture: This market map does not include livestock-related technologies (with a few notable exceptions in integrated tech and imagery analytics), including aquaculture, or indoor farming as I remain largely focused on the wealth of innovations for the outdoor farming world. (My colleague Michael Rose did a great Indoor AgTech Landscape in 2019)

Seana Day is a Partner at Better Food Ventures and The Mixing Bowl, with 15 years of finance, M&A and technology experience. She is the author of the 2019 Agtech Landscape and Livestock Tech Landscape. Seana now lives in Turlock, the heart of California’s Ag land. This blog post originally appeared on AgFunder News.