The 2025 Crop Robotics Landscape, Mapping Progress and Possibility

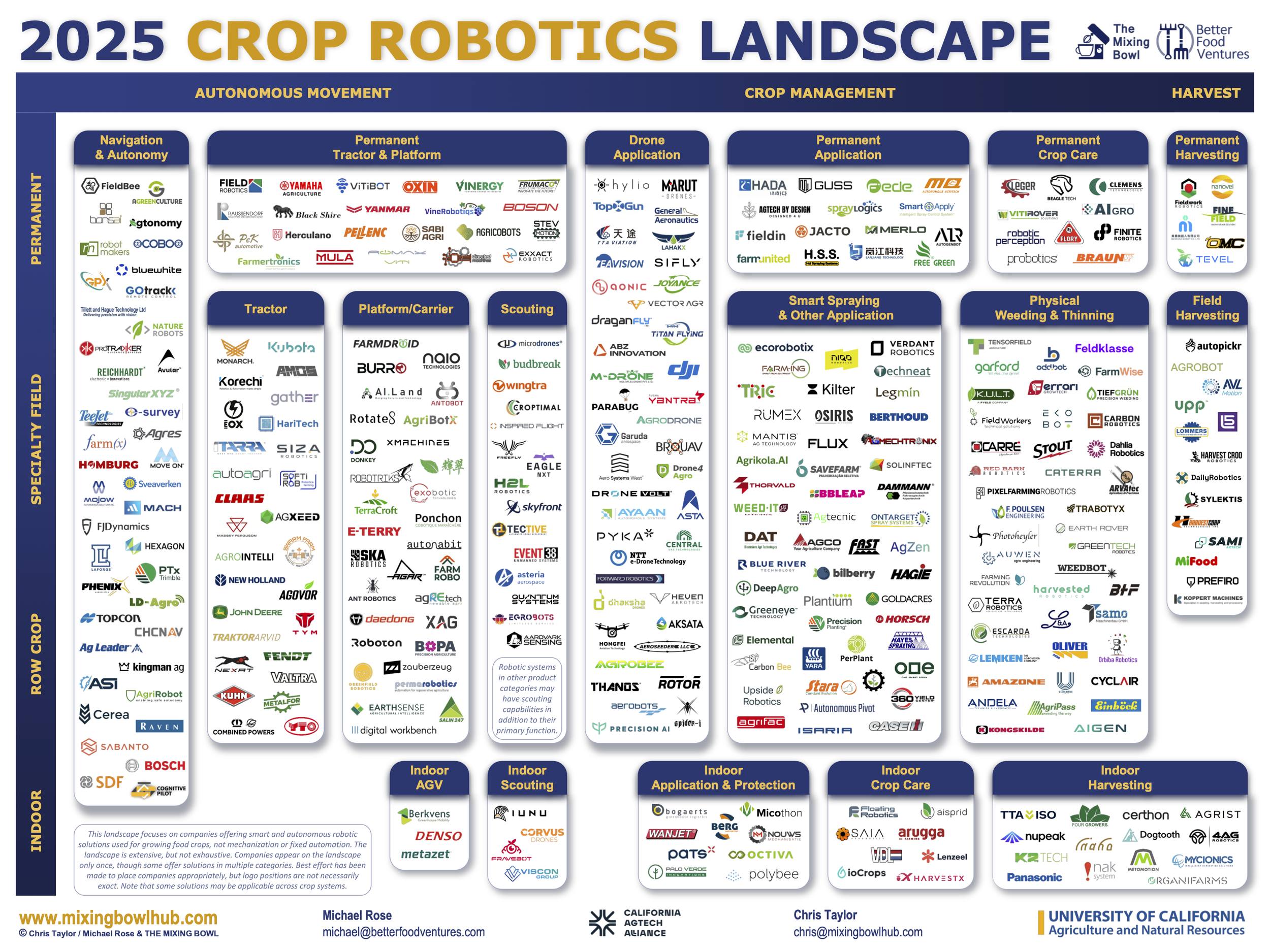

The Mixing Bowl’s 2025 Crop Robotics Landscape builds upon the 2024 edition to provide an expanded and refined picture of the companies creating robotic solutions for growing food crops. Over the past year, the sector has continued to mature—new entrants have emerged, established players have sharpened their focus and strategic acquisitions have strengthened positions for the future.

Michael Rose is a Partner at Better Food Ventures and The Mixing Bowl where he brings more than 25 years immersed in new venture creation and innovation as an operating executive and investor across the Food Tech, AgTech, restaurant, Internet, and mobile sectors.

Chris Taylor is a Partner at The Mixing Bowl, where he leverages 25 years of experience in market discovery and solutions innovation across design and manufacturing, healthcare, and agricultural technology to help clients navigate the evolving landscape of food and agriculture.

Rob Trice founded Better Food Ventures to invest in startups harnessing IT for positive impact in Agrifoodtech and The Mixing Bowl to connect food, agriculture and IT innovators for thought and action leadership.

From 2024 to 2025: An Evolving Landscape

This year’s landscape continues to represent the most comprehensive mapping of the crop robotics, capturing more than 350 companies worldwide. These companies are grouped into 17 task/product segments and arranged by major crop system and broad functional area.

While the total number of companies represented increased only modestly from 2024, that stability conceals significant market turnover. Roughly 15 percent of the 2024 companies exited the 2025 edition, while 20 percent of those appearing in 2025 are new entrants—an indicator of a dynamic and highly competitive innovation environment.

Defining the Framework of the Landscape

For the purposes of this mapping, a crop robot is defined as:

“A machine that uses hardware and software to perceive its surroundings, analyze data, and take real-time action on information related to an agricultural crop function without human intervention.”

In practical terms, included companies offer autonomous navigation or vision-aided precision or a combination in their robotic offerings. These robots can take unplanned yet appropriate actions—such as navigating variable field conditions, identifying targets or adjusting inputs—in real time in the unstructured and changing environments typical of agriculture.

The landscape focuses on robotic solutions for planting to harvest of food crops. Pre-production nursery and post-harvest solutions are not included, nor are robotics for livestock, dairy and cannabis production. Also, excluded from this landscape are:

Sensor-only or analytics-only systems (where separate action is required)

Repetitive mechanization or pre-determined automation without perception or autonomy

Early-stage concepts not yet at the demonstrable-prototype stage

Non-commercial endeavors, academic and consortium research projects

Note that each company appears only once, based on its primary domain of activity, and our best-effort placement reflecting publicly available information and manufacturer claims. The resulting landscape is extensive though not exhaustive—its aim is to clarify rather than to completely capture a rapidly shifting industry.

The landscape is segmented vertically by crop production system: permanent specialty, field-grown specialty, broadacre row crops, and indoor. The Landscape is also segmented horizontally by broad functional area: autonomous movement, crop management, and harvest. Within those functional areas are the more specific task/product segments described here:

Autonomous Movement

Navigation & Autonomy - more sophisticated autosteer systems with headland turning capability and autonomous navigation systems

Tractor - autonomous tractors and implement carriers, i.e., machines that primarily provide motive power and towing capability

Platform/Carrier - multi-use autonomous platforms and tool carriers that might perform multiple tasks and/or support various tools

Permanent Tractor & Platform - autonomous tractors and multi-use platforms specifically targeting vineyards and orchards

Indoor AGV - automated guided vehicles typically used in greenhouses

Crop Management

Scouting - autonomous mapping and scouting robots and aerial drones; note that many robots appearing in other task/product categories have scouting capabilities in addition to their primary function

Indoor Scouting - autonomous mapping and scouting within an indoor environment

Drone Application - spraying and spreading aerial drones

Smart Spraying & Other Application - autonomous and/or vision-guided spray weeding and thinning and other input application, including vision-based application control systems

Permanent Application - autonomous and/or vision-guided input application for permanent crops

Indoor Application & Protection - autonomous and/or vision-guided input application

Physical Weeding & Thinning - autonomous and/or vision-guided physical weeding and thinning using mechanical, laser, heat or electrical systems

Permanent Crop Care - autonomous and/or vision-guided maintenance of the plant canopy and ground in vineyards and orchards

Indoor Crop Care - autonomous indoor deleafing, pollination, lowering, etc

Harvest

Harvesting - crop sector-specific autonomous and/or precision harvesting robots for permanent, specialty field and indoor crops

Observations from 2025: Progress with Purpose

The 2025 Crop Robotics Landscape reveals a sector advancing steadily toward greater autonomy and intelligence across diverse production systems—from indoor environments to open-field row and specialty crops and permanent plantings. The solutions continue to target areas where repetitive mechanization and automation are not sufficient or not practical.

Key observations from the 2025 analysis include:

Continued traction in row-crop autonomy, where navigation and guidance systems are commonly in use and can also enhance existing equipment via retrofits

Steady growth in weeding and spraying robotics, now among the most active areas for both venture investment and deployment

A significant increase in the number of solutions targeting permanent crop production

Continued independence of sensing and control systems from equipment, particularly for navigation and precision application; nearly half of the companies in the Smart Spraying & Other Application segment are add-on sensor/controller systems, not integrated spray rigs

A rising pipeline of smaller robotic platforms and carriers, including autonomous tractors and lightweight multipurpose units designed for modular attachments

Scouting and application drones continue a steady growth trajectory, with faster adoption outside the United States

Persistent macro-drivers continue to push the sector forward—a chronic shortage of skilled labor and associated costs; rising input costs and a focus on resource efficiency; competitive and productivity pressures; and changing growing conditions. These pressures are accelerating demand for autonomy and precision, even as the path to scale remains complex.

Geographically, Europe accounts for nearly half of all identified companies, led by innovation clusters in The Netherlands, Germany and France. The United States leads all countries with 22% of the total—nearly half of which are California-based—reflecting its strong alignment of agtech entrepreneurship, venture capital, and production agriculture.

Funding activity in 2025 remains active, underscoring investor confidence in the long-term potential of crop robotics, particularly for companies with robust products and good market fit. Notable examples include Ecorobotix ($150M), SwarmFarm ($30M), 4AG ($29M), iUNU ($20M), Agtonomy ($18M), Saga Robotics ($11.5M), TRIC ($5.5M), Bonsai ($15M), the XAG IPO filing, and the acquisition of GUSS Automation by John Deere.

Looking Forward: From Promise to Practice

A “robotic revolution” in agriculture is still in its early stages, but market drivers continue to increase the push towards autonomy and precision in production agriculture while robotic offerings mature. The market mirrors the trajectory of other emerging ag innovation arenas: deliberate in pace, but compounding in impact as capabilities, cost structures, and trust improve.

Progress in autonomous navigation, drones, and precision spraying and weeding continues, while harvesting remains the most technically challenging frontier. Wider adoption across the sector will depend on overcoming scaling limitations and regulatory barriers that constrain autonomous operation in open fields.

Equally important is the human dimension. As robotics adoption grows, the agricultural workforce is undergoing a transition that demands new skills—system maintenance, data interpretation, and digital farm management—creating opportunities for training and inclusive technology deployment.

The Mixing Bowl’s 2025 Crop Robotics Landscape illustrates a field in motion: still forming, increasingly sophisticated, and foundational to the future of sustainable crop production.

Acknowledgements

We would like to thank the California AgTech Alliance and University of California Agriculture and Natural Resources for their continued support of innovation in agriculture and of this crop robotics landscaping initiative. We would also like to acknowledge all the startups and innovators who are working tirelessly to make crop robotics a much needed reality. A special thanks to those entrepreneurs and investors that spoke with us and provided a unique view into the challenges and excitement of building a crop robotic business.